Artificial intelligence (AI) is continually evolving, and its impact on app development, especially in the financial technology (fintech) sector, is undeniable. With user expectations on the rise, the integration of AI in app development has become crucial for staying competitive. According to Statista, the AI market is expected to grow significantly, reaching nearly $2 trillion by 2030, with fintech playing an important role in driving this growth. In this blog, we'll explore the influence of AI and machine learning (ML) on fintech app development, the benefits it brings, and the challenges that developers need to overcome.

How AI and ML Impact Fintech App Development

It's essential to distinguish between AI and ML. AI is a broader concept where machines simulate human intelligence, while ML is a subset of AI focusing on machines learning from data without explicit programming. In fintech app development, AI encompasses various aspects, including chatbots for customer support and fraud detection, making apps smarter and more user-friendly.

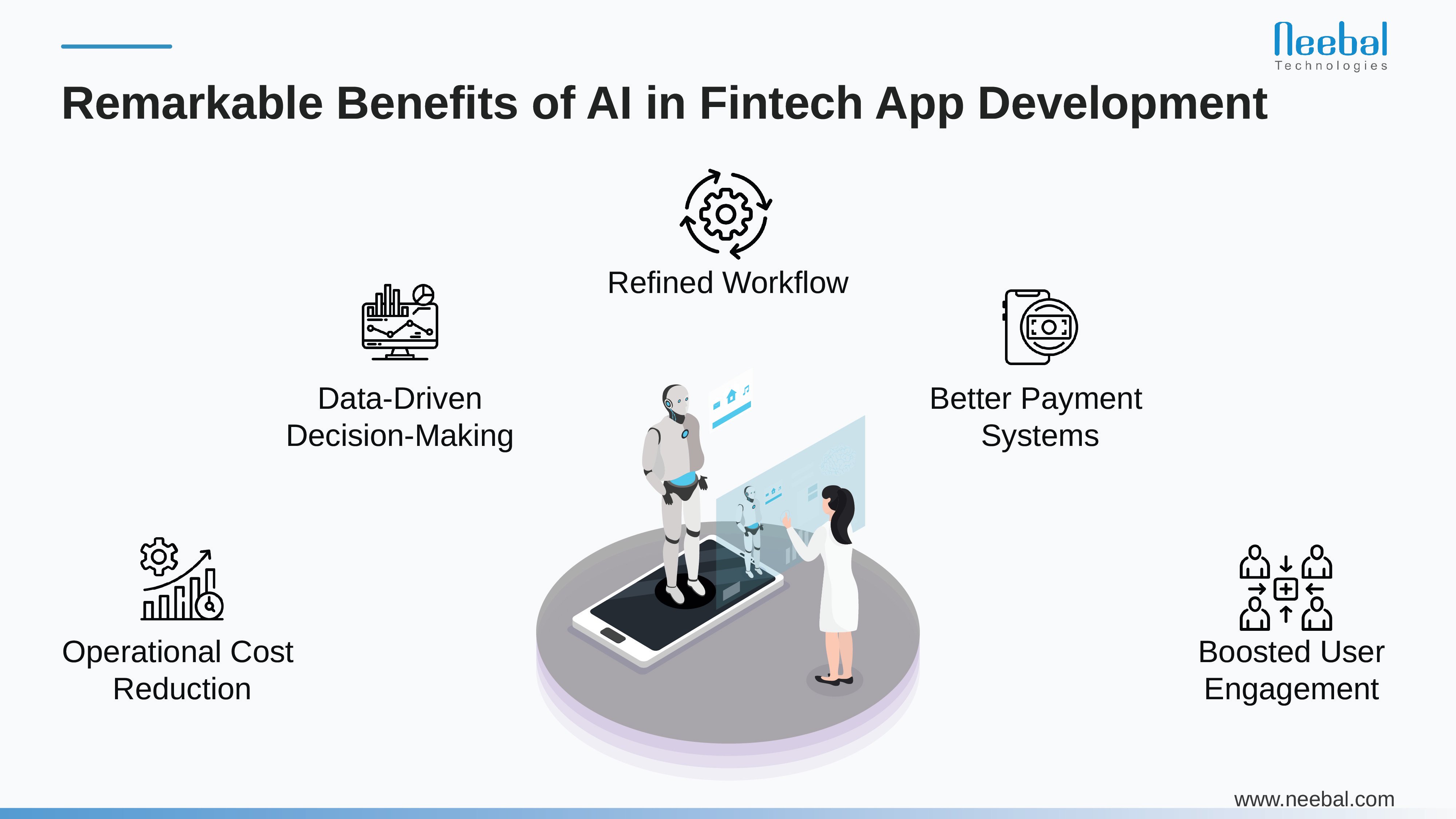

Remarkable Benefits of AI in Fintech App Development

- Operational Cost Reduction: Fintech apps leverage intelligent automation powered by AI to cut operational expenses, making financial services more affordable and accessible.

- Boosted User Engagement: AI facilitates instant query resolution, ensuring prompt responses that lead to higher user satisfaction and increased engagement.

- Better Payment Systems: AI oversees user verification and enhances payment security, making transactions safer and smoother. Companies like PayPal and Square utilize ML to prevent fraudulent transactions and improve overall user experience.

- Data-Driven Decision-Making: Fintech companies use AI to analyze vast amounts of data, gaining insights into customer behavior and market trends. This data-driven approach helps in shaping better financial services and products.

- Refined Workflow: AI streamlines workflow by automating repetitive tasks in customer support, reducing human errors, and making the process smoother and more accurate.

- Major Use Cases of AI in Fintech App Development in 2023: The adoption of AI in fintech app development is evident across various domains, with some key use cases driving innovation:

- Automated Customer Support: Chatbot adoption in banking is predicted to result in global cost savings of $7.3 billion by the end of 2023. Cloud-based call center software enhanced by AI offers efficient and multilingual customer support, revolutionizing the user experience.

- Robotic Process Automation (RPA): RPA uses software robots to automate rule-based tasks, improving efficiency and security. Fintech companies utilize RPA for tasks such as new customer onboarding, security verification, and loan processing.

- Personalization: AI algorithms analyze diverse data sources to offer personalized insights, allowing fintech apps to learn about user preferences and tailor marketing efforts accordingly.

- AI-Powered Financial Advisor: Digital assistants powered by AI offer users personalized financial advice and money management services, revolutionizing how individuals manage their finances and make informed decisions.

- AI Stock Trading: AI-powered stock trading, facilitated by robo-advisors, analyzes extensive datasets to execute trades at optimal prices, enhancing market forecasting accuracy.

- Early Fraud Detection: AI plays a vital role in efficiently identifying fraudulent activities, and enhancing security measures in the financial sector.

- AI-Related Challenges in Fintech App Development: While the benefits of AI in fintech app development are substantial, there are challenges that developers need to navigate for successful implementation:

- Difficulty in Automating Processes: AI, unlike rule-based automation, requires learning from experience. Identifying the best opportunities for AI automation in fintech processes can be challenging and often necessitates professional guidance.

- Scalability Challenge: Scaling AI technologies can be challenging, especially with large volumes of data and increasing demands. Techniques like parallel processing, distributed computing, and cloud infrastructure can enhance performance and manage larger workloads seamlessly.

- Legal Considerations: Stricter rules and regulations in the financial sector require careful consideration. Ensuring fairness and transparency in processes, as well as compliance with regulations is crucial for legal and ethical fintech app development.

- Security Concerns: Security remains a significant concern, especially when dealing with sensitive financial data. Robust security measures must be integrated into fintech apps to safeguard against potential breaches or unauthorized access.

- Future Trends in AI for Fintech App Development: Looking ahead, the landscape of AI in fintech app development is poised for exciting advancements. Emerging trends include the integration of natural language processing (NLP) for more seamless user interactions, the use of predictive analytics for personalized financial forecasting, and the incorporation of blockchain for enhanced security and transparency in financial transactions.

These trends signify a future where AI becomes even more integral to the evolution of fintech apps, offering users innovative and sophisticated solutions.

Enhancing Financial Literacy Through AI

AI is playing a pivotal role in promoting financial literacy among users. Fintech apps can leverage AI algorithms to provide educational content tailored to individual user needs. From interactive budgeting guides to personalized investment tutorials, AI-driven features empower users to make informed financial decisions.

This not only encourages a deeper understanding of financial concepts but also contributes to building a more financially literate user base. As AI continues to evolve, its potential to democratize financial knowledge becomes a key driver in empowering individuals to navigate the complexities of personal finance with confidence.

Conclusion

As AI continues to shape the future of fintech app development, the opportunities it brings are vast. From enhanced user experiences to operational efficiency and improved decision-making, the benefits are evident. However, developers must address challenges such as scalability, legal considerations, and security to ensure the successful integration of AI in fintech apps. As the fintech landscape evolves, embracing AI will be essential for staying at the forefront of innovation and providing users with advanced, secure, and personalized financial services

Neebal excels in navigating challenges and seizing opportunities in AI implementation for FinTech. Our expert team harnesses AI's power, addressing complexities to optimize financial processes. With a focus on innovation, we pave the way for our clients, ensuring seamless integration of AI to unlock the full potential of fintech advancements.