Advancements in technology are reshaping the industry, and artificial intelligence (AI) is at the forefront of this transformation. One particular facet of AI, known as Natural Language Processing (NLP), is proving to be a game-changer for fintech. In this blog, we'll explore how NLP is revolutionizing financial services, making processes more efficient, and enhancing the overall customer experience.

Smart Chatbots

The use of AI-powered chatbots is skyrocketing in the financial sector, and projections indicate that these intelligent bots will save a staggering 862 million hours for financial institutions in 2023. The key to making these interactions more seamless lies in NLP, a form of AI that makes chatbots smart and easy to interact with. NLP ensures that clients feel more comfortable using conversational tech, leading to significant time, cost, and energy savings.

How NLP Works in Finance

NLP in finance relies on sophisticated neural network-based AI algorithms specialized in complex language analysis. Unlike earlier chatbots limited by pre-programmed scripts, NLP chatbots learn and evolve with each customer interaction through dynamic conversation. Major players in the financial industry, such as Bank of America, HDFC in India, and more, have already deployed innovative NLP chatbots to serve their customers.

Benefits of NLP in Fintech

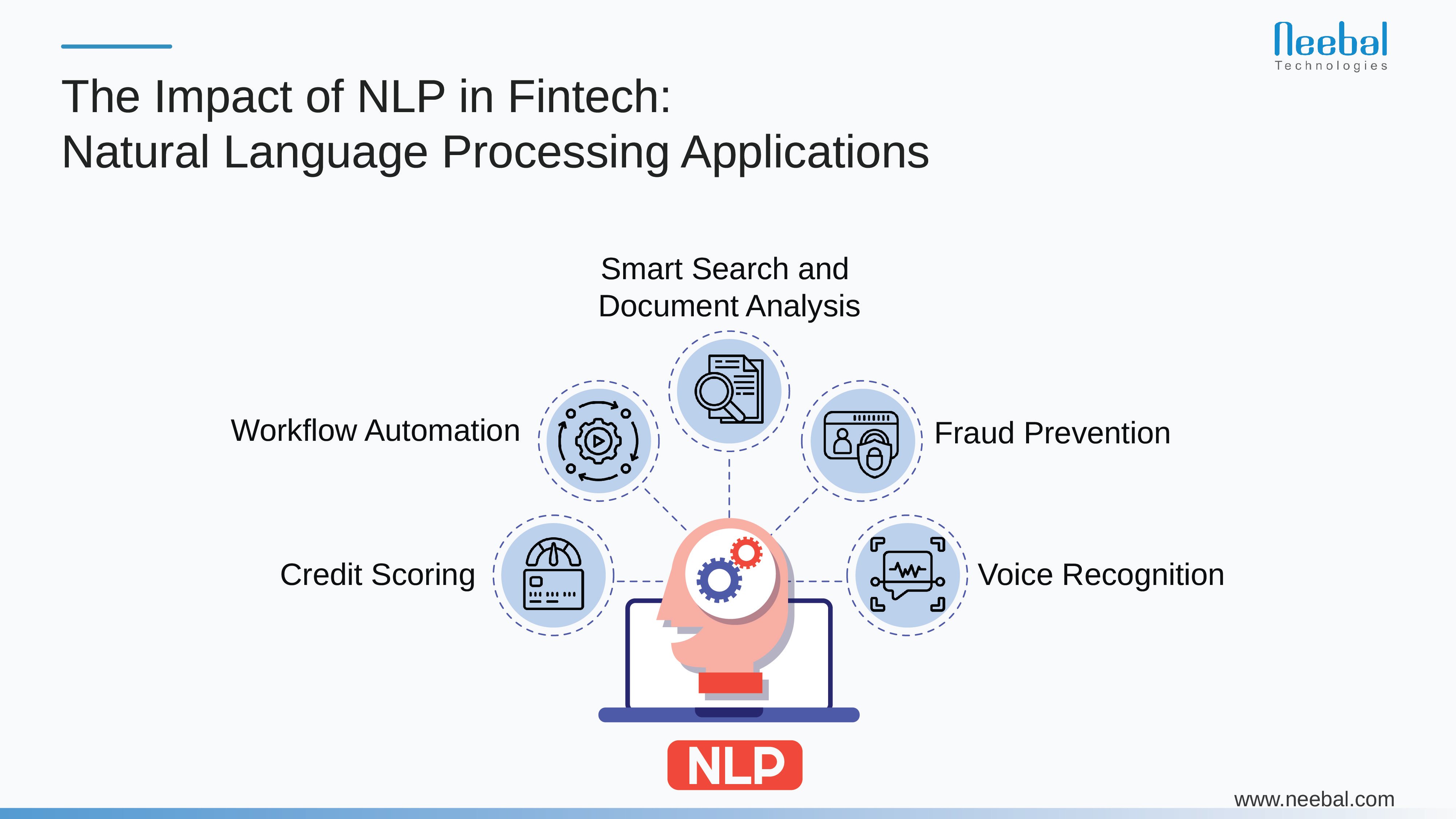

NLP-powered tools offer a variety of benefits to the fintech industry:

- Workflow Automation: Basic chatbots save money by resolving customer issues without human intervention.

NLP-powered automation goes a step further, gathering data to enable personalized financial services and products based on customer sentiment and behavior. - Smart Search and Document Analysis: NLP-based systems simplify administration by streamlining document generation.

Advanced NLPs can analyze vast databases, offering comprehensive results by understanding the language's structure, and going beyond keyword-based indexing. - Fraud Prevention: Named Entity Recognition (NER), a branch of NLP, enhances risk management by detecting real-life concepts in unstructured text, improving data privacy and security.

- Credit Scoring: Conversational chatbots, powered by NLP, assess customers' loan or credit card requests by analyzing digital footprints and providing accurate credit scores.

- Voice Recognition: Beyond security, voice recognition aids data gathering, allowing NLP applications to analyze presentations and keynote addresses for valuable information.

NLP Use Cases in Finance

Some of the most impactful and near-future applications of NLP in finance include:- Sales and CRM Optimization: NLP enhances customer engagement and acquisition by powering CRM software, automating data logging, and evaluating patterns for strategic insights.

- Investment and Trading Applications: Passive market research becomes efficient with NLP, providing rapid and accurate data assessment for investment decisions.

- Content Marketing Creation: NLP-powered chatbots are evolving to create engaging and coherent content, enhancing personalization options for marketing strategies.

- Customization Challenges and Solutions: While NLP technology offers numerous advantages, it comes with challenges. The risk lies in the machine learning process, where algorithms may learn the wrong lessons if the training data doesn't truly represent real-world scenarios. Proper validation and attention to detail are crucial to ensure reliable results. However, once properly set up and validated, the machine continues learning from its successes, making it a powerful tool for the financial sector.

Real-world Examples

Vention, a leading technology solutions provider, has successfully implemented NLP in various projects:

For MSB.ai, an engineering workflow automation platform, an automatic system for machine learning training, and a programmable synthesis model were built, requiring NLP for functionality.

With Equeum, a global platform supporting the financial industry with content creation, machine learning, and neural networks were paired to create a predictive tool for an AI platform analyzing stock ticker indices.

Enhancing Customer Engagement with NLP

One of the remarkable outcomes of implementing NLP in finance is the enhancement of customer engagement. NLP-powered chatbots, with their ability to understand and respond to natural language, create a more conversational and user-friendly experience. Customers no longer feel like they're interacting with a robotic system but instead find the experience similar to chatting with a knowledgeable friend. This shift in engagement positively impacts customer satisfaction scores and fosters a more positive perception of financial services.

Moreover, NLP's ability to analyze customer sentiments and preferences during interactions allows financial institutions to tailor their services better. By understanding the mood and satisfaction levels of customers, institutions can adapt and improve their offerings, creating a more personalized and customer-centric approach.

Future Trends in NLP and Finance

Looking ahead, the collaboration between NLP and finance is sure to reach new heights. Future trends include even more advanced personalization, where NLP not only understands the words but also the context and emotions behind them. This evolution will lead to more sophisticated chatbots that anticipate customer needs and provide proactive assistance.

Moreover, NLP's integration with voice recognition technology is on the rise. As more consumers become comfortable with voice interactions, NLP-powered voice assistants are set to become as prevalent as their text-based counterparts, further expanding the accessibility and convenience of financial services.

Conclusion

Natural Language Processing is reshaping the landscape of fintech, offering a plethora of benefits from workflow automation to fraud prevention. By minimizing the negative experience of chatbot interactions, NLP is making financial services more accessible and user-friendly. As we witness the continued evolution of NLP applications in finance, the industry is on the brink of a transformative era where efficiency, personalization, and data-driven decision-making take center stage. Embracing NLP is not just a trend; it's a strategic move towards a more intelligent and customer-centric future for the financial services industry

Neebal harnesses the power of Natural Language Processing (NLP) to transform financial services. Our solutions deploy NLP-powered chatbots for enhanced customer engagement, streamlined processes, and improved accessibility to financial information. With a focus on ethical AI practices, Neebal pioneers innovative approaches to delivering personalized, efficient, and inclusive financial solutions.