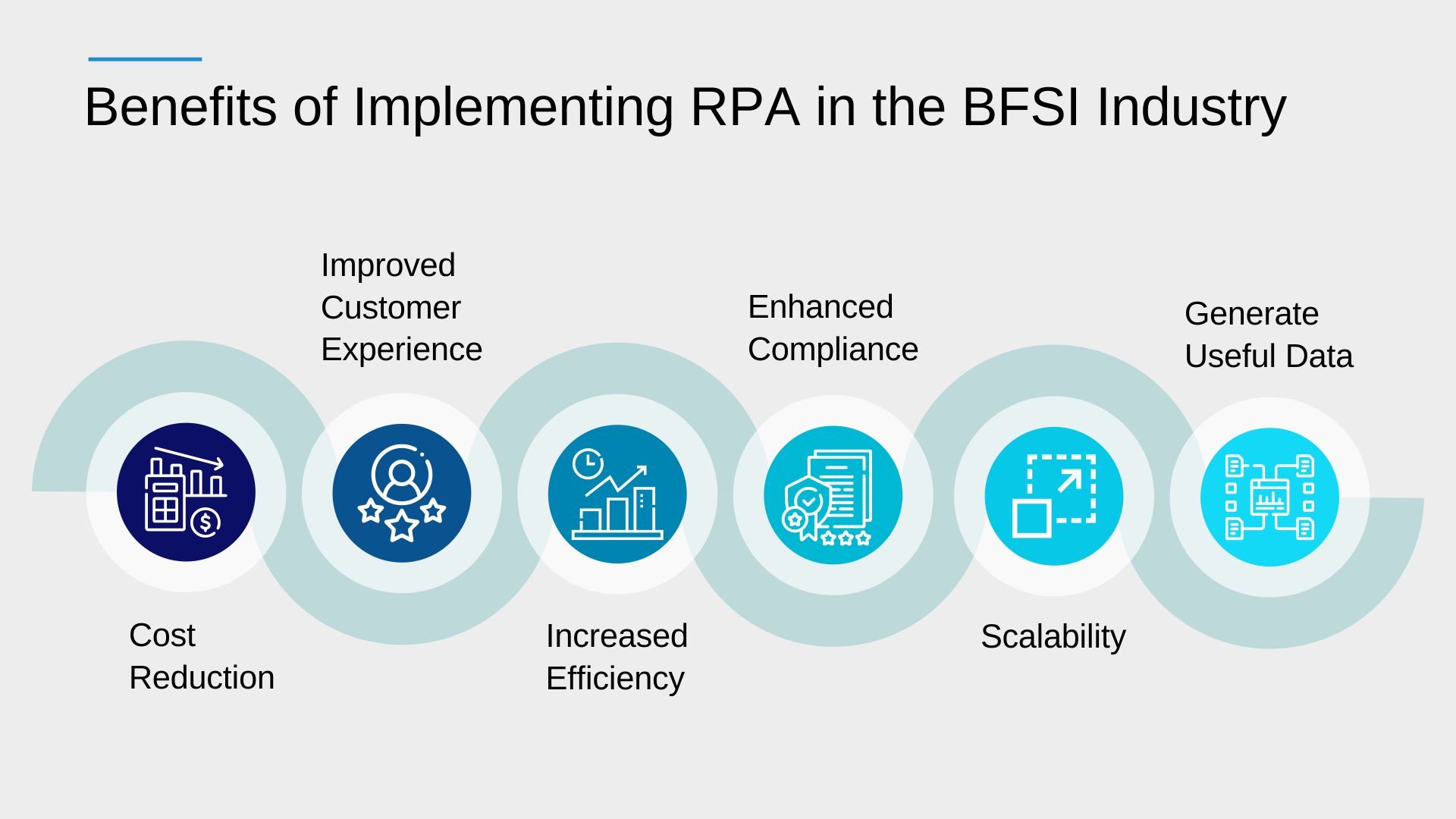

The BFSI (Banking, Financial Services, and Insurance) industry has always been a leader in adopting innovative technology to improve its processes and enhance its customer experience. Robotic Process Automation (RPA) is one such technology that has gained significant traction in the BFSI industry in recent years. In this blog, we will discuss the benefits of RPA for the BFSI industry.

Cost Reduction:

The BFSI industry is a highly regulated industry that involves a lot of paperwork and manual processes, which can be costly and time-consuming. RPA can automate these processes, resulting in a significant reduction in operational costs. For example, RPA can automate loan application processing, reducing the need for manual data entry and review, which can save banks and financial institutions significant time and money.

Improved Customer Experience:

The BFSI industry is customer-centric, and improving customer experience is essential for business growth. RPA can automate repetitive and time-consuming tasks, allowing customer service representatives to focus on delivering better customer service. This can lead to faster response times, increased accuracy, and enhanced customer satisfaction.

Increased Efficiency:

The BFSI industry deals with a large amount of data and paperwork. RPA can automate data entry and processing, reducing the time required for data processing and increasing efficiency. This can enable banks and financial institutions to process applications faster, reduce the turnaround time for account opening, and reduce the time required for customer onboarding.

Enhanced Compliance:

The BFSI industry is subject to various regulations and compliance requirements. RPA can help automate compliance-related tasks such as KYC (Know Your Customer), AML (Anti-Money Laundering), and regulatory reporting. This can reduce the risk of errors, improve compliance, and save the time and effort required to comply with regulatory requirements.

Scalability:

The BFSI industry is highly competitive, and the ability to scale is essential for growth. RPA can automate repetitive and time-consuming tasks, making it easier for banks and financial institutions to scale their operations. RPA can handle an unlimited number of tasks, which can enable BFSI organizations to scale their operations without having to increase their workforce.

Data Analytics:

The BFSI industry generates a large amount of data, and data analytics is critical for business growth. RPA can automate data collection and analysis, providing banks and financial institutions with the insights they need to make informed business decisions. RPA can also help identify fraud and other anomalies, enabling banks and financial institutions to take proactive measures to protect their customers and their business.

conclusion:

RPA has several benefits for the BFSI industry, including cost reduction, improved customer experience, increased efficiency, enhanced compliance, scalability, and data analytics. As the BFSI industry continues to evolve, RPA will play an increasingly important role in streamlining processes, improving operations, and enhancing customer satisfaction.